What is tax return software?

Filing a tax return involves reporting your income for the previous year and determining the amount of tax you owe.

You make necessary deductions for income, expenses, health insurance, pensions, life insurance, medical expenses, etc., and then pay the tax that corresponds to your final income.

If you have paid too much tax, you can receive a refund. There are two

types of tax return: the "blue return," which requires bookkeeping but allows you to receive tax benefits, and the "white return," which does not require bookkeeping but does not allow tax benefits.

Here we will introduce software that will make each type of return more convenient.

You make necessary deductions for income, expenses, health insurance, pensions, life insurance, medical expenses, etc., and then pay the tax that corresponds to your final income.

If you have paid too much tax, you can receive a refund. There are two

types of tax return: the "blue return," which requires bookkeeping but allows you to receive tax benefits, and the "white return," which does not require bookkeeping but does not allow tax benefits.

Here we will introduce software that will make each type of return more convenient.

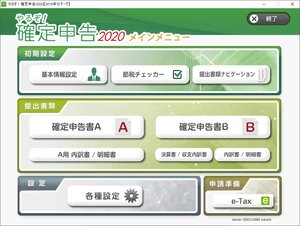

Free tax return software

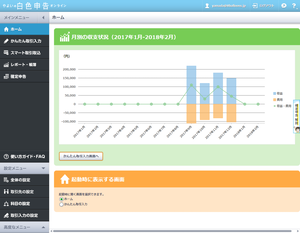

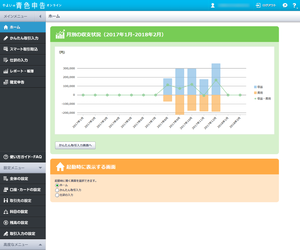

- Provided by: Yayoi Co., Ltd.

- Provided by: Yayoi Co., Ltd.*This software is , but you can try out all of its functions for free for one year .

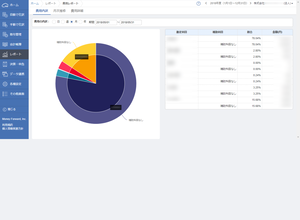

- Supported OS: Windows, Mac, iOS, AndroidProvided by: freee Inc.*This software is , but you can try it for free for 30 days.

- Supported OS: Windows, Mac, iOS, AndroidProvided by: Money Forward, Inc.* All features can be used free of charge for one month (corporations can try the business plan, and sole proprietors can try the personal plan).

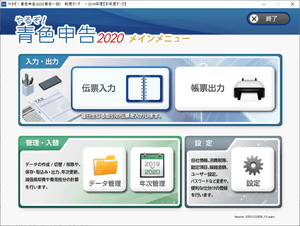

- Supported OS: Windows 10/11, macOSProvided by: Rio Co., Ltd.

- Supported OS: Windows 10/11, macOSProvided by: Rio Co., Ltd.